Top Guides for Freeing Yourself from Debt

Managing Consumer Debt Effectively: A Strategic Approach

James HurstMarch 9, 2025

Effective Strategies for Managing Consumer Debt in 12 Simple Steps

James HurstMarch 9, 2025

Managing Consumer Debt: 12 Essential Steps to Financial Freedom

Roy JordanMarch 8, 2025

Understanding Debt

Mind-Blowing Strategies to Wipe Out Debt in as Little as 12 Days

Roy JordanMarch 7, 2025

Breaking Free from Debt: A New Era of Financial Freedom

The burden of debt has become a universal experience for many individuals, leaving them feeling trapped and helpless. However, with the right strategies in place, it's possible to wipe out de...

15 Essential Strategies for Managing Consumer Debt Effectively

Roy JordanMarch 7, 2025

Unbelievable Debt-Crushing Secrets: 12 Hidden Techniques to Pay Off Your Loans in Half the Time

Ken WarnerMarch 7, 2025

The Hidden Cost of ‘Good’ Debt: How Consumer Lending Can Sneak Up On You

Roy JordanMarch 7, 2025

11 Debt-Beating Secrets Insiders Use to Get Out of Financial Jail

Roy JordanMarch 7, 2025

Building & Rebuilding Credit

How To Stay Debt-Free After Paying Off Debt

Roy JordanFebruary 18, 2025

Avoiding overspending can be tricky, but recognizing and avoiding triggers is key to maintaining financial stability.

One of the first steps in avoiding overspending is identifying your personal trigg...

Rebuilding After Ruin: A Guide To Repairing Credit After Bankruptcy

Ken WarnerFebruary 17, 2025

What To Do If Your Debt Is Sold To A Collection Agency

James HurstFebruary 7, 2025

Debt 101: The Basics Of Borrowing

James HurstJanuary 30, 2025

How Late Payments Affect Your Credit

James HurstJanuary 28, 2025

Creditors & Collections

The Different Types Of Debt: Secured, Unsecured, And Beyond

James HurstJanuary 13, 2025

As you continue to learn about different types of debt, it's important to be aware of other forms beyond secured and unsecured.

Student loans, payday loans, and tax debt are three common types that can have a significant impact on your financial well...

Building Wealth After Debt: An Introduction To Investing

Roy JordanJanuary 4, 2025

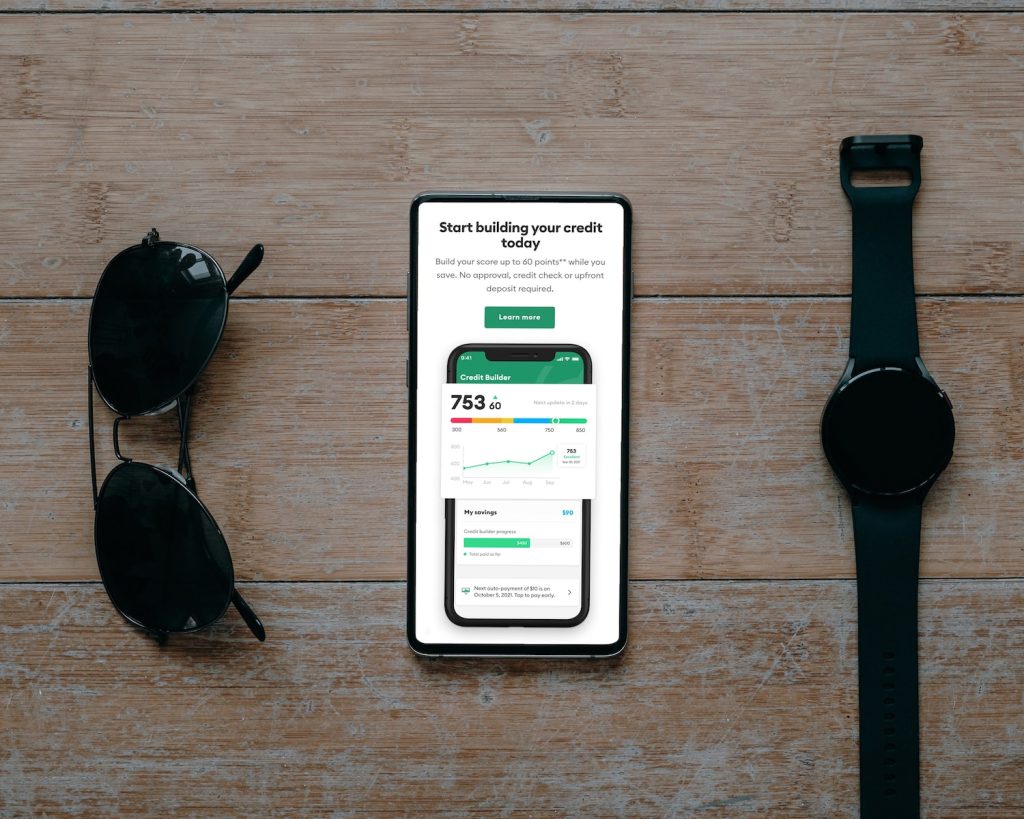

How A Personal Loan Can Help Build Your Credit

Ken WarnerDecember 29, 2024

Understanding Your Credit Report And Credit Score

James HurstDecember 25, 2024

How To Write A Cease And Desist Letter To A Debt Collector

James HurstDecember 20, 2024

Debt Reduction

Effective Strategies for Managing Consumer Debt in 12 Simple Steps

James HurstMarch 9, 2025

1. Face Your Debt Head-On

Taking the first step is always the hardest part. It's time to confront your consumer debt head-on by gathering all relevant information about your outstanding balances, int...

14 Essential Steps to Achieving Financial Stability

James HurstMarch 8, 2025

The Hidden Cost of ‘Good’ Debt: How Consumer Lending Can Sneak Up On You

Roy JordanMarch 7, 2025

How To Create A Debt Reduction Plan

James HurstOctober 31, 2024

Dealing With Medical Debt: A Step-By-Step Guide

James HurstSeptember 27, 2024

Life After Debt

Student Loans: What You Need To Know

James HurstSeptember 26, 2024

The Snowball Method Vs The Avalanche Method: Which Is Right For You?

James HurstDecember 12, 2024

The Importance Of Regular Credit Check-Ups

Roy JordanNovember 27, 2024

Strategies For Boosting Your Credit Score

Roy JordanJanuary 21, 2025

Understanding Secured Credit Cards: A Tool For Rebuilding Credit

Ken WarnerSeptember 26, 2024