Do you know what your credit score is? If not, it’s time to start paying attention. Your credit score can impact everything from the interest rates on loans and credit cards to your ability to rent an apartment or get a job. That’s why it’s so important to regularly check up on your credit health.

In this article, we’ll explore the benefits of regular credit check-ups and provide tips for maintaining good credit health over time. We’ll discuss how to understand your credit reports and scores, identify errors on your report, dispute those errors with the credit bureaus, and prevent identity theft through regular monitoring.

By following these best practices, you can improve your credit score and feel more confident in your financial standing.

Key Takeaways

- Regular credit check-ups are crucial for maintaining good credit health.

- Checking credit reports regularly can catch errors and potential fraud or identity theft.

- Good credit score leads to better opportunities for financial growth and stability.

- Inaccuracies on credit report can negatively impact creditworthiness and ability to obtain loans or lines of credit.

Understanding Credit Reports and Scores

You’ll want to take a closer look at your credit reports and scores, so you can better understand what lenders see and make sure that everything is accurate.

Your credit report is a detailed summary of your credit history, including all the accounts you’ve opened or closed, your payment history, and any outstanding debts. Your credit score is a numerical representation of how likely you are to repay debt on time.

It’s important to regularly check your credit reports for errors or inaccuracies. Even small mistakes can have a big impact on your credit score and could potentially hurt your chances of getting approved for loans or credit cards in the future.

By reviewing your reports regularly, you can catch any errors early on and work to correct them before they cause too much damage.

In addition to checking for errors, monitoring your credit reports can also help you identify potential fraud or identity theft. If you notice any unfamiliar accounts or transactions on your report, it’s important to act quickly by reporting them to the appropriate authorities and taking steps to protect yourself from further harm.

Overall, staying on top of your credit reports and scores is an essential part of maintaining good financial health and ensuring that you’re able to access the best possible loan terms when you need them most.

Benefits of Regular Credit Check-Ups

It’s crucial to stay aware of your credit status by frequently reviewing it, as this can help prevent potential financial troubles down the road. Regular credit check-ups allow you to monitor any changes in your credit score and report, which can alert you to any fraudulent activity or errors that may negatively impact your creditworthiness. By catching these issues early on, you can take steps to correct them before they become bigger problems.

In addition to preventing financial troubles, regular credit check-ups also provide a sense of control over your finances. Knowing where you stand financially can help you make informed decisions about borrowing money or making large purchases. It also allows you to identify areas where you may need to improve your credit habits, such as paying bills on time or reducing debt.

Staying on top of your credit status through regular check-ups can lead to better opportunities for financial growth and stability. A good credit score opens doors for lower interest rates on loans and credit cards, which can save you money in the long run. It also shows lenders that you are a responsible borrower who is likely to pay back debts on time, increasing your chances of being approved for future loans or lines of credit.

Overall, taking the time to review your credit regularly is an investment in your financial well-being and future success.

Identifying Errors on Your Credit Report

If you come across mistakes on your credit report, take note of them and address the issues promptly to ensure accurate financial records. Errors can negatively impact your credit score, making it harder for you to obtain loans or lines of credit. Additionally, these inaccuracies could potentially be a sign of identity theft.

One common error is incorrect personal information such as an incorrect name or address. This may seem minor, but if creditors can’t verify your identity due to discrepancies like this, it can lead to delays in obtaining credit.

Another common mistake is inaccurate account information such as missed payments or incorrect balances. These errors should be disputed with the credit bureaus and corrected as soon as possible.

Regularly reviewing your credit report and addressing any errors is crucial in maintaining good financial health. It ensures that you have accurate records and helps protect against potential fraud or identity theft. By taking proactive steps towards monitoring your credit report, you’re showing that you’re responsible and aware of your financial situation – a trait that lenders value when considering loan applications.

Disputing Errors with Credit Bureaus

Don’t let errors on your credit report go unnoticed – disputing mistakes with the credit bureaus is crucial for maintaining accurate financial records and protecting against potential fraud. Here are three things you need to know about disputing errors with credit bureaus:

-

Start by getting a copy of your credit report from each of the three major credit reporting agencies: Equifax, Experian, and TransUnion. Review each report carefully for any inaccuracies or discrepancies.

-

If you find an error, write a dispute letter to the credit bureau that issued the report containing the mistake. In your letter, explain what information is incorrect and provide any documentation to support your claim.

-

The credit bureau has 30 days to investigate and respond to your dispute. If they agree that there is an error, they must correct it on your credit report and notify any lenders who may have received inaccurate information about you.

Disputing errors with credit bureaus can be time-consuming, but it’s worth it to ensure that your financial records are accurate and up-to-date. By taking proactive steps to correct mistakes on your credit report, you’ll have peace of mind knowing that lenders will see an accurate reflection of your financial history when evaluating loan applications or extending lines of credit.

Preventing Identity Theft Through Credit Check-Ups

Protect yourself from identity theft by regularly checking your credit report for any suspicious activity. Identity theft is a growing concern, and it can happen to anyone at any time.

By staying vigilant and monitoring your credit report, you can catch potential fraudulent activity before it becomes a major problem. Checking your credit report on a regular basis allows you to identify any signs of identity theft early on.

This could include accounts that you didn’t open or charges that you don’t recognize. If you do notice anything suspicious, be sure to contact the credit bureau immediately to dispute the information and have it removed from your report.

In addition to checking your credit report, there are other steps you can take to protect yourself from identity theft. These include shredding sensitive documents before throwing them away, using strong passwords for online accounts, and being cautious about sharing personal information online or over the phone.

By taking these precautions and regularly monitoring your credit report, you can reduce the risk of becoming a victim of identity theft.

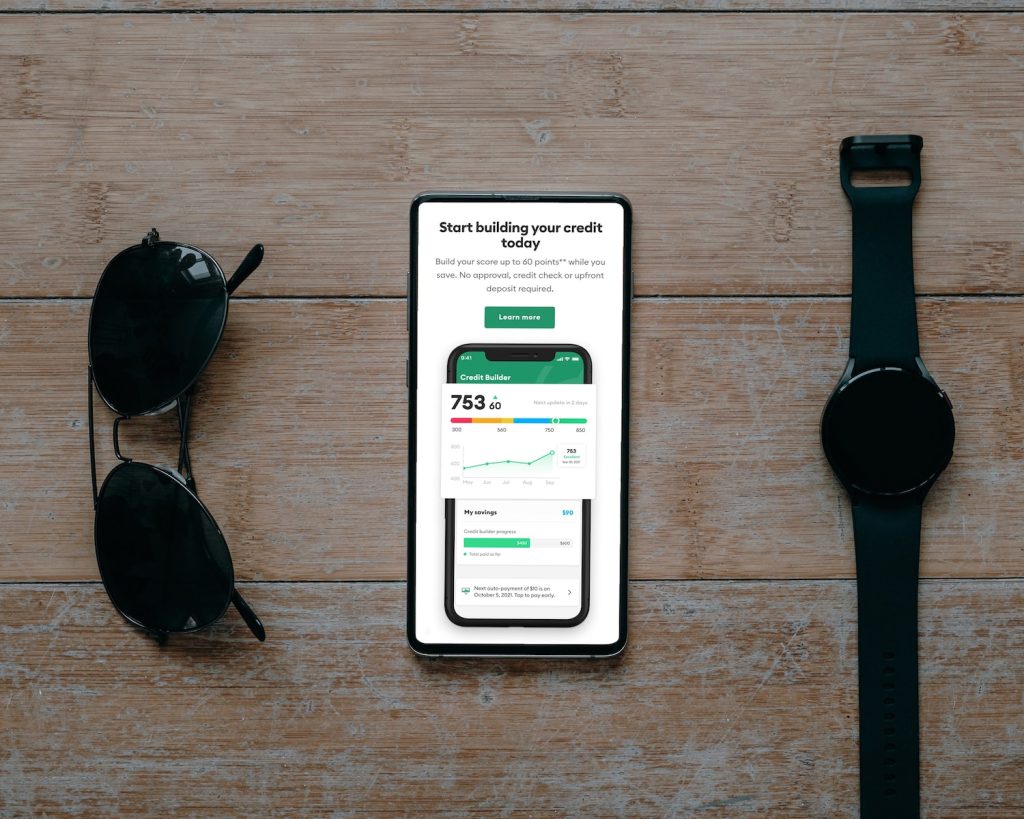

Improving Your Credit Score Over Time

Now that you know how credit check-ups can prevent identity theft, let’s talk about improving your credit score over time. It’s important to understand that your credit score is a reflection of your financial habits and history. The higher it is, the more likely you are to be approved for loans and credit cards with better terms.

One way to improve your credit score is by making timely payments on all of your accounts. Late payments can have a negative impact on your score, so it’s crucial to pay on time every month. Another strategy is keeping a low balance on your credit cards, as high balances can also hurt your score.

It’s best to avoid opening too many new accounts at once, as this could make lenders see you as a risky borrower. Instead, focus on building good habits with the accounts you already have and using them responsibly.

By taking these steps over time and regularly checking up on your credit report, you’ll be well on your way to achieving a great credit score – and all the benefits that come with it!

Best Practices for Maintaining Good Credit Health

Maintaining good credit health involves consistently practicing responsible financial habits and making timely payments on all of your accounts. This not only ensures that you have a healthy credit score, but it also helps you build a strong financial foundation.

Here are some best practices to maintain good credit health:

-

Make payments on time: Late or missed payments can significantly harm your credit score. Set up automatic payments or reminders to ensure that you never miss a due date.

-

Keep your credit utilization low: The amount of available credit you use impacts your credit score. Aim to keep your utilization below 30% and pay off balances in full each month.

-

Use credit responsibly: Only apply for the credit you need and can afford to repay. Avoid opening multiple new accounts at once as this can negatively impact your score.

By following these best practices, you can maintain good credit health and continue building a strong financial future. Remember, small actions taken consistently over time can lead to significant improvements in your overall financial well-being.

So make sure to regularly check in on your accounts and adjust where necessary to ensure that you’re staying on track towards achieving your goals.

Frequently Asked Questions

How often should I check my credit report?

You should check your credit report at least once a year to ensure accuracy and identify any potential fraud. It’s important to track changes and address any errors promptly to maintain a healthy credit score.

Can checking my credit report too often hurt my credit score?

Checking your credit report too often won’t hurt your score. In fact, it’s recommended to check it regularly to catch errors and fraud early. Use a reputable credit monitoring service for peace of mind.

Will checking my credit report and score show up as a hard inquiry on my credit report?

No, checking your credit report and score will not show up as a hard inquiry on your credit report. It is important to regularly check your credit to stay informed and avoid errors or fraud that could harm your credit score.

How long do negative items stay on my credit report?

Negative items can stay on your credit report for up to seven years, and bankruptcies can remain for up to ten years. Regularly checking your credit report can help you identify and dispute any errors or inaccuracies that may be negatively impacting your score.

What should I do if I find errors on my credit report that I cannot dispute with the credit bureaus?

If you find errors on your credit report that cannot be disputed with the credit bureaus, contact the creditor directly. Provide evidence of the error and request a correction. Regularly checking your credit report can help catch errors early.

Conclusion

Now that you understand the importance of regular credit check-ups, it’s time to take action.

By monitoring your credit report and score, you can identify errors and prevent identity theft. Regular check-ups also provide an opportunity to improve your credit health over time.

To maintain good credit health, it’s important to practice responsible financial habits such as paying bills on time and keeping debt levels low. With a little effort, you can build a strong credit history that will benefit you in the long run.

Remember to regularly check your credit report and score to ensure that they accurately reflect your financial standing and protect yourself from potential fraud. By taking these steps, you can secure a brighter financial future for yourself.