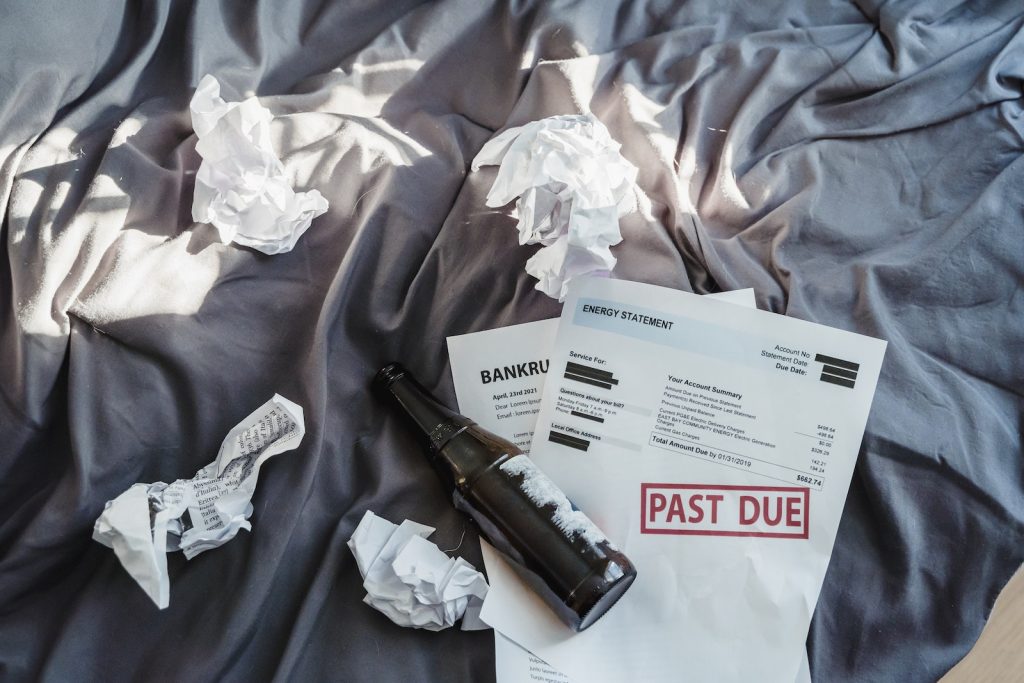

Are you feeling overwhelmed and discouraged about your financial future after filing for bankruptcy? It’s understandable to feel this way, but the good news is that rebuilding your credit is possible.

With some determination and effort, you can start to improve your credit score and regain control of your finances.

In this article, we’ll walk you through some practical steps for rebuilding your credit after bankruptcy. From understanding your credit report to practicing good financial habits, we’ll provide you with actionable tips that will help you get back on track.

So, let’s get started on the road towards a healthier financial future!

Key Takeaways

- Understanding your credit report is crucial. Check for accuracy in the personal information, accounts, and public records sections.

- Developing a budget and financial plan based on income, expenses, and debts is important. Prioritize debt payments and make minimum payments on all accounts.

- Establishing positive payment history can be done through a secured credit card or credit-builder loan. Becoming an authorized user on someone else’s credit account can also help.

- Practicing good financial habits, such as sticking to a budget, paying bills on time, and saving for emergencies, is essential. Consider other strategies like secured loans or secured credit cards and alert credit bureaus if there are discrepancies in credit score or report information.

Understand Your Credit Report

Don’t freak out when you see your credit report after bankruptcy – it’s important to take the time to understand it, so you can start rebuilding your credit with confidence.

Your credit report is a snapshot of your financial history and it will include information about your debts, payment history, and any bankruptcies or collections that have been reported. Take a careful look at each section of the report and make sure all the information is accurate.

Start by examining the personal information section which includes your name, address, and social security number. Make sure everything is correct because mistakes here could lead to issues down the road.

The next section will show all of your accounts including open loans, credit cards, and mortgages. Check for any missed payments or late fees which could affect your score negatively.

The final section shows public records such as bankruptcies or tax liens. This is where you’ll find information about your bankruptcy filing so make sure it’s accurate. If there are any errors on the report, dispute them with the credit bureau immediately because these mistakes could hold back your progress in rebuilding your credit after bankruptcy.

Develop a Budget and Financial Plan

When it comes to developing a budget and financial plan, you need to start by setting realistic goals for yourself. This means taking into account your income, expenses, and any outstanding debts that you may have.

Once you have a clear idea of what you want to achieve financially, it’s important to prioritize your debt payments so that you can work towards becoming debt-free as soon as possible.

By doing this, you’ll be able to take control of your finances and put yourself in a better position for the future.

Set Realistic Goals

Start by figuring out what you want to achieve and setting realistic goals for rebuilding your credit after bankruptcy. It’s important to have a clear idea of what you want to accomplish so that you can create a plan that will help you get there. Setting goals also gives you something to work towards, which can help keep you motivated and focused.

To set realistic goals, start by taking stock of your current financial situation. Look at your income, expenses, and debts to determine how much money you have available each month to put towards rebuilding your credit. Then, use the table below as a guide for setting specific goals that are achievable based on your budget and timeline. Remember, it may take time to see significant improvements in your credit score, so be patient and stay committed to the process.

| Goal | Timeline | Action Steps |

|---|---|---|

| Pay off outstanding debts | 1 year | Create a budget and prioritize paying off high-interest debts first |

| Establish new credit accounts | 6 months | Apply for secured credit card or loan with low minimum deposit/credit limit |

| Make all payments on time | Ongoing | Set up automatic payments or reminders for due dates |

| Monitor credit report regularly | Quarterly | Check report for errors or fraudulent activity |

| Increase credit limit/available credit | 2 years+ | Demonstrate responsible use of existing accounts before requesting increases |

By setting realistic goals and taking intentional steps towards achieving them, you can rebuild your credit after bankruptcy and improve your overall financial health. Remember to celebrate small wins along the way and seek support from friends, family members, or a financial advisor if needed. You’ve got this!

Prioritize Debt Payments

To get on track with your finances, it’s important to focus on paying off your outstanding debts as a top priority. This means making sure that you are making at least the minimum payments on all of your accounts each month.

You should also consider prioritizing your debt by focusing on paying off high-interest accounts first, as these will cost you more money in the long run.

If you have any extra funds available, put them towards paying down debt rather than spending them elsewhere. This could mean cutting back on unnecessary expenses or finding ways to increase your income.

The key is to stay committed and consistent in your efforts to pay down your debt, as this will ultimately help you rebuild your credit and improve your financial situation overall. Remember, every little bit counts!

Open a Secured Credit Card

One great way to rebuild your credit after bankruptcy is by opening a secured credit card. This can help you establish a positive payment history and improve your credit score over time.

A secured credit card works by requiring you to make a deposit upfront that will then be used as collateral for your line of credit. This makes it less risky for the lender and allows them to offer you a card even with poor or no credit.

When choosing a secured credit card, it’s important to do your research and compare fees and interest rates. Look for cards with low fees and reasonable interest rates, as these will help keep costs down while you work on rebuilding your credit. Additionally, make sure the issuer reports to all three major credit bureaus so that your good payment history will be reflected in your credit report.

Once you have opened a secured credit card, use it responsibly by making small purchases each month and paying off the balance in full before the due date. This will show lenders that you are capable of managing debt responsibly and can help improve your overall financial health.

Over time, as you build up a positive payment history, you may be able to graduate to an unsecured card or qualify for other types of loans with better terms.

Consider a Credit-Builder Loan

If you’re looking to boost your credit score and establish a positive payment history, considering a credit-builder loan could be a smart move. This type of loan is specifically designed for those who are looking to rebuild their credit after bankruptcy or other financial setbacks. A credit-builder loan works by allowing you to borrow money that is held in an account until it is paid off in full.

The payments you make on the loan are reported to the credit bureaus, which can help improve your credit score over time. Additionally, because the funds are held in an account until the loan is paid off, you won’t have access to the money during this time period. This can help prevent you from overspending or making poor financial decisions.

To give you a better idea of how a credit-builder loan works, take a look at this table:

| Pros | Cons | Tips |

|---|---|---|

| Helps build credit history | Funds may not be accessible during repayment period | Choose a lender with low fees and interest rates |

| Can improve credit score over time | May require collateral such as savings account or CD | Make timely payments each month |

| Teaches disciplined borrowing habits | Lengthy repayment period may result in paying more in interest overall | Pay off loan early if possible |

Overall, if used responsibly, a credit-builder loan can be an effective tool for rebuilding your credit after bankruptcy. It’s important to do your research and choose a lender with fair terms and reasonable fees before committing to any agreement. With consistent payments and responsible borrowing habits, you can work towards improving your financial standing and achieving long-term financial success.

Become an Authorized User on Someone Else’s Account

Becoming an authorized user on someone else’s credit account can be a helpful way to improve your credit score and establish a positive payment history. This strategy is particularly useful if you’ve recently filed for bankruptcy and need to rebuild your credit. Here are some tips to make the most out of this opportunity:

-

Choose someone with good credit: Being added as an authorized user on someone else’s account will only help you if that person has a good track record of making payments on time and keeping their balances low.

-

Set clear expectations: Make sure you discuss how much access you’ll have to the account, what purchases you’re allowed to make, and who’s responsible for paying off the balance.

-

Monitor your credit report: Keep track of any changes in your credit score or discrepancies in the information reported on your credit report. Alert both the primary cardholder and the credit bureaus if there are any issues.

-

Use it responsibly: Although you aren’t legally responsible for making payments on the account, it’s still important that you use it responsibly. Only charge what you can afford to pay back and avoid carrying a balance from month-to-month.

-

Have a backup plan: While being an authorized user can help improve your credit score, it shouldn’t be relied upon as your sole method of rebuilding after bankruptcy. Be sure to also consider other strategies such as secured loans or secured credit cards.

By following these tips, becoming an authorized user on someone else’s account can be one part of a comprehensive plan for rebuilding your credit after bankruptcy. Remember that improving your financial health takes time and effort, but by taking small steps consistently over time, you can achieve long-term success.

Practice Good Financial Habits

Developing good financial habits can be a key factor in achieving long-term financial success, such as creating and sticking to a budget, paying bills on time, and saving for emergencies. These are especially important after bankruptcy to rebuild your credit score. Here are some tips on how to practice good financial habits:

Firstly, it’s essential to create a budget and stick to it. This will help you manage your income better and avoid overspending. You can use a budgeting app or software to help you keep track of your expenses easily. Make sure you include all your bills, including any debt payments you have, in your monthly budget.

Secondly, always pay your bills on time. Late payments can negatively impact your credit score and make it more challenging to rebuild it after bankruptcy. Consider setting up automatic payments for recurring bills so that you never miss a payment.

Lastly, start saving for emergencies if you haven’t already done so. An emergency fund can help cover unexpected expenses like car repairs or medical bills without having to rely on credit cards or loans. Aim to save at least three months’ worth of living expenses in an emergency fund.

| Financial Habits | Benefits | How To Implement |

|---|---|---|

| Creating a Budget | Helps manage income better by avoiding overspending | Use budgeting apps or software |

| Paying Bills On Time | Avoids negative impacts on credit score | Set up automatic payments for recurring bills |

| Saving For Emergencies | Covers unexpected expenses without relying on credit cards or loans | Save at least three months’ worth of living expenses in an emergency fund |

By practicing these good financial habits consistently, you’ll be well on the way towards rebuilding your credit after bankruptcy and achieving long-term financial success. Remember that developing these habits takes time and effort – but the rewards will be worth it!

Monitor Your Progress

As you work towards achieving financial stability after bankruptcy, it’s important to monitor your progress regularly. This means keeping track of your budget and savings on a consistent basis. By doing this, you’ll be able to see how far you’ve come and what areas you still need to improve on.

One way to monitor your progress is by setting specific financial goals for yourself. Whether it’s saving a certain amount each month or paying off a credit card bill, having clear objectives can help keep you motivated and focused. You can even use apps or tools that allow you to track your spending habits and monitor your credit score.

It’s also important to celebrate small victories along the way. Even if it feels like progress is slow, any improvement is worth acknowledging. This will help boost your confidence and keep you motivated as you continue working towards rebuilding your credit after bankruptcy.

Remember that every step counts, no matter how small they may seem at first glance.

Frequently Asked Questions

Can bankruptcy be removed from your credit report before the typical 7-10 year timeframe?

Unfortunately, bankruptcy cannot be removed from your credit report before the typical 7-10 year timeframe. However, there are steps you can take to rebuild your credit and improve your financial standing over time.

How long does it typically take to see an improvement in your credit score after implementing these strategies?

You can expect to see an improvement in your credit score within a few months of implementing strategies like paying bills on time, keeping credit utilization low, and checking for errors on your credit report. It’s important to stay consistent and patient.

Will opening a secured credit card negatively impact your credit score?

Opening a secured credit card won’t negatively impact your credit score. In fact, it can help rebuild credit by showing responsible behavior. Use it wisely and always pay on time to see improvement.

What is the difference between a credit-builder loan and a traditional personal loan?

Looking to improve your credit? A credit-builder loan is specifically designed to help you establish or rebuild your credit. Unlike a traditional personal loan, the funds are not immediately available and payments are reported to credit bureaus as on-time.

How frequently should you check your credit report and credit score while rebuilding credit after bankruptcy?

To rebuild credit after bankruptcy, check your report and score at least once a year. However, you may want to do so more frequently to monitor progress and catch errors. Seeing improvement can be motivating for continued efforts.

Conclusion

Congratulations! You’ve taken the first step towards rebuilding your credit after bankruptcy.

It may seem like a daunting task, but with dedication and patience, you can improve your credit score over time.

Remember to keep track of your credit report and develop a budget and financial plan that works for you.

Consider opening a secured credit card or taking out a credit-builder loan to start building positive credit history.

You can also become an authorized user on someone else’s account to further boost your score.

But the most important factor in rebuilding your credit is practicing good financial habits, such as making payments on time and keeping balances low.

Monitor your progress regularly and celebrate small victories along the way.

By following these steps, you can rebuild your credit and improve your financial future.

Remember that it takes time, but with persistence and determination, you can achieve success.

Good luck on your journey!